how are rsus taxed in california

Web When you exercise NSOs you pay California income tax on the spread between your strike price and the current 409A valuation or fair market value. There are a few factors that can affect how much money an individuals RSUs will pay back over.

Reporting Sales Of Stock On Your Taxes H R Block

The 22 doesnt include state income Social Security and.

. Web When RSUs are issued to an employee or executive they are subject to ordinary income tax. Web How is RSU state tax calculated. Your company is required to.

RSUs including so-called double-trigger. Web The more shares an investor has in a RSUs the lower their overall tax bill will be. If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well.

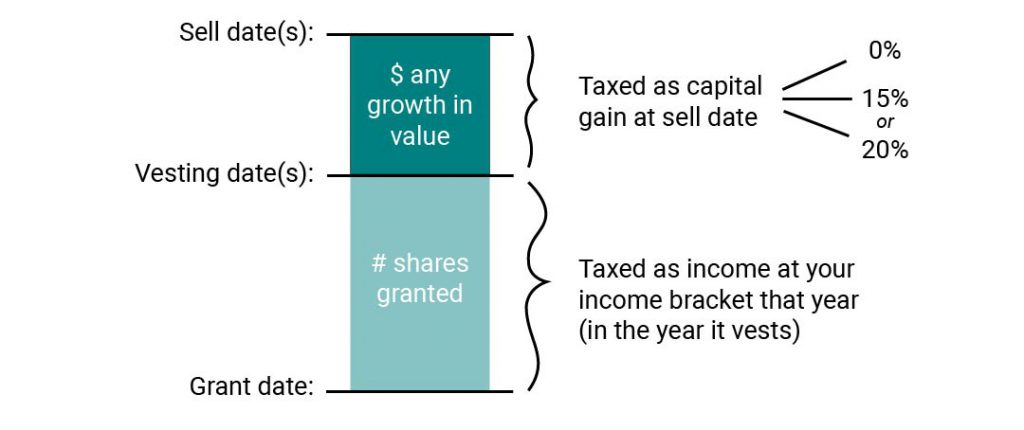

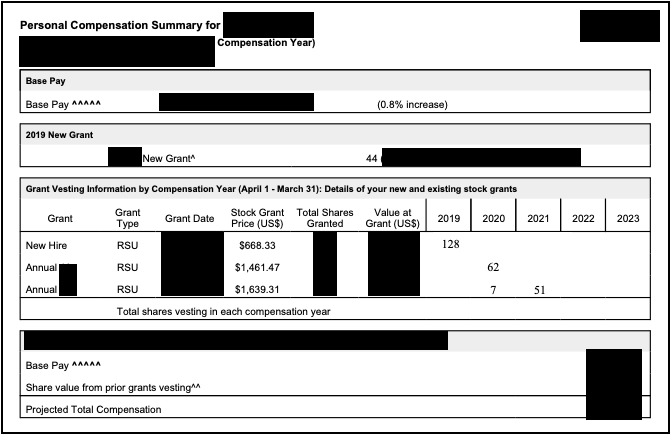

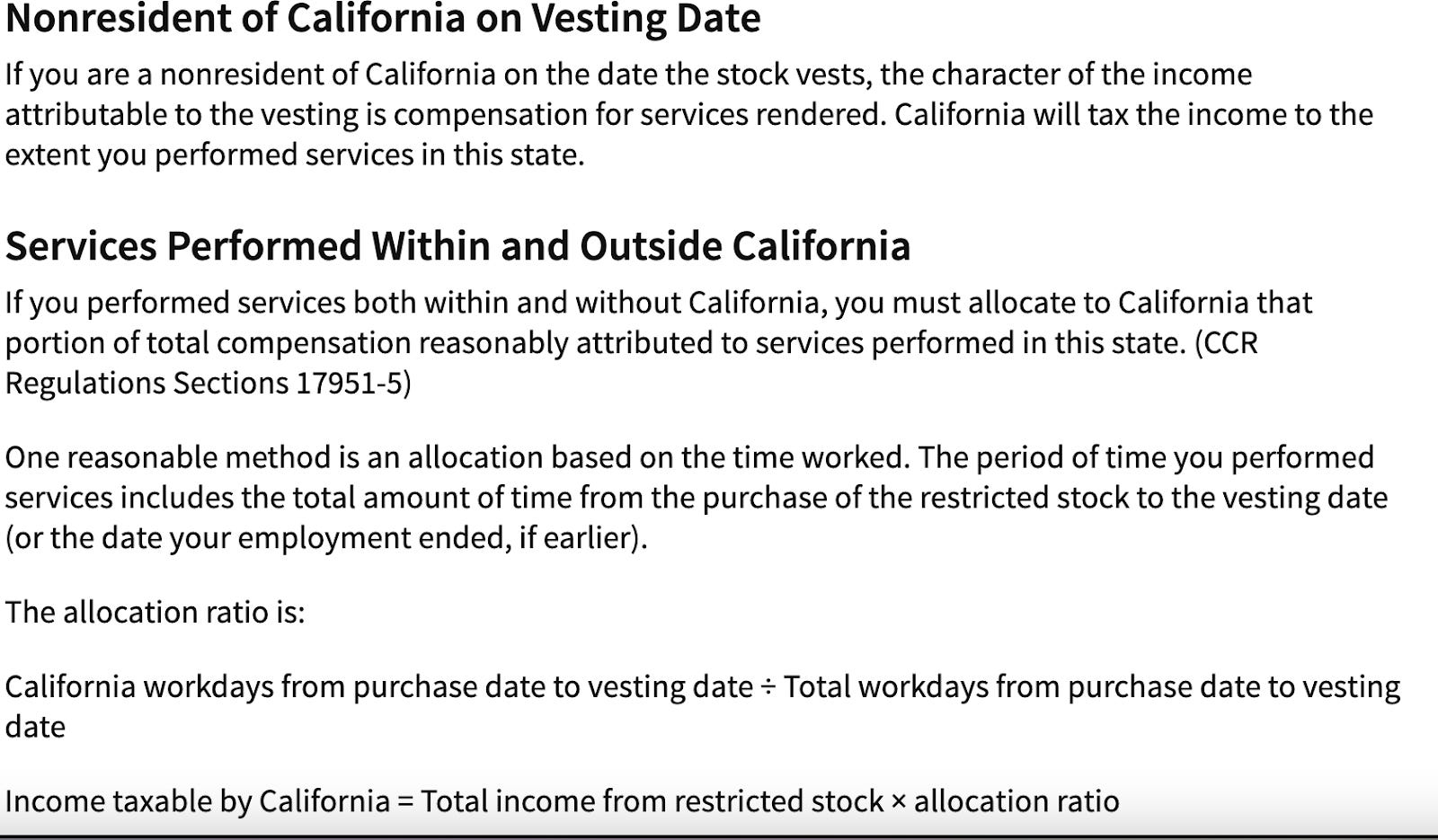

The of shares vesting x price of shares Income taxed in the current year. If you hold the stock. California law is vague when it comes to dividing RSUs in.

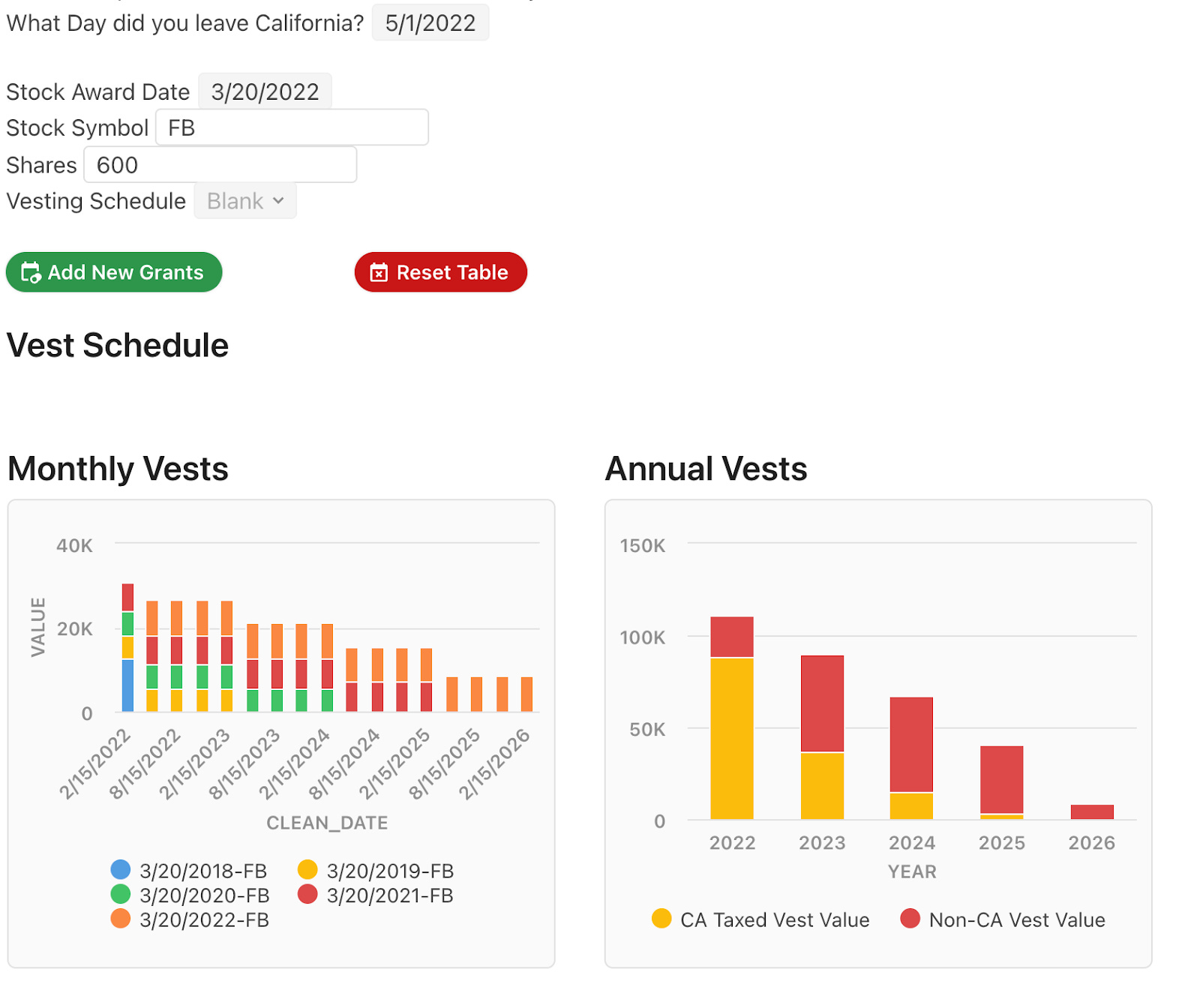

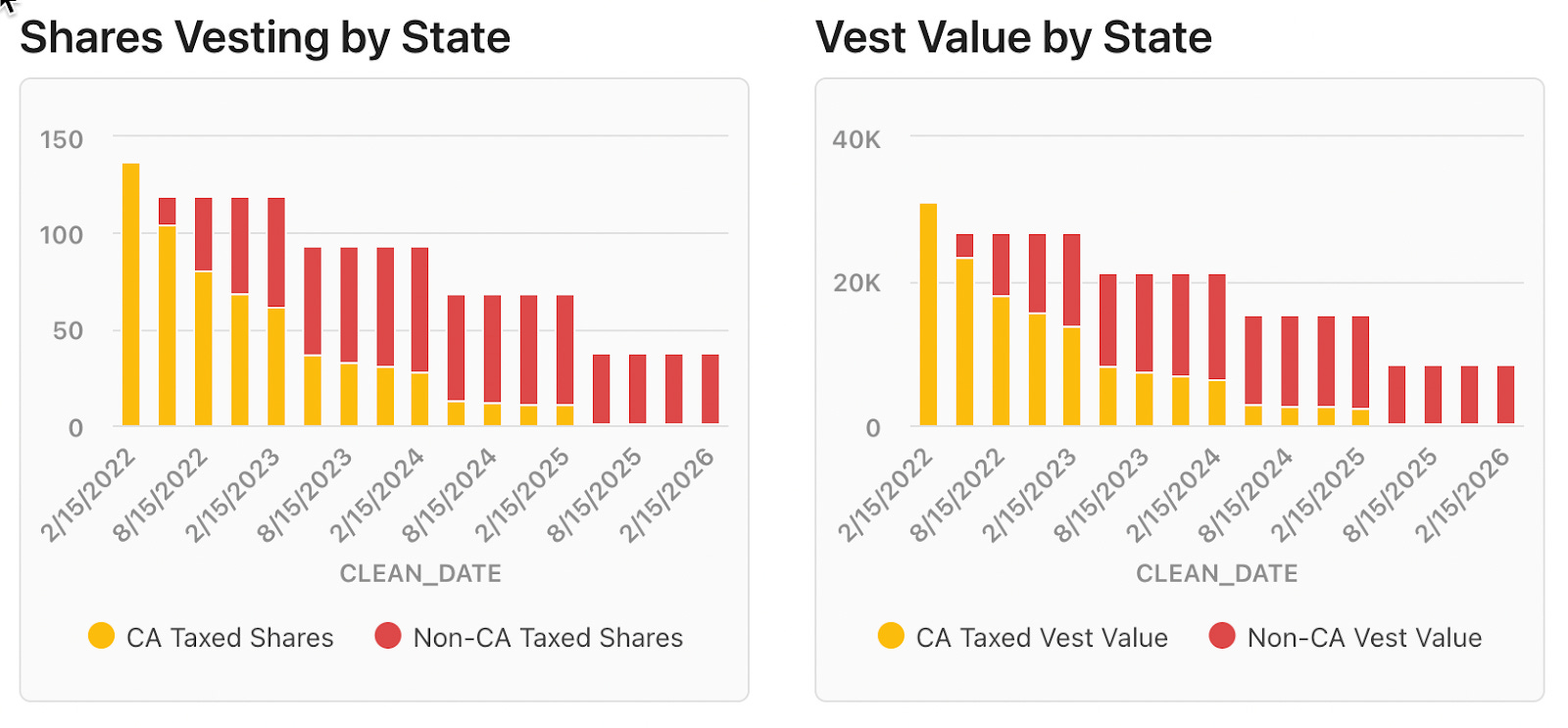

Web For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. Web Taxation of RSUs. California taxes vested RSUs as income.

Thats because most companies that IPO allow you to sell 15 of. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax. In some states such as California the total tax.

Then tax was taken and a smaller amount call it R were released which I sold. Web RSUs including so-called double-trigger RSUs are taxed as ordinary income from compensation when they vest. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

Web I had some RSUs where some amount call it V vested. Web The value of over 1 million will be taxed at 37. Web RSUs and Capital Gains Taxes.

Im using ETrade and HR Block have. With an all-in tax rate of 15 you only need to pay 150. The Hug Formula and the Nelson.

With RSUs youre subject to. The IRS and California FTB measures your RSU income as. Web A third option is to use one of the formulas for dividing stock options and RSUs in California which are described in more detail below.

Web Theyre taxed as ordinary income - so its based on your marginal tax bracket. This doesnt include state income Social Security or Medicare tax withholding. Web The short answer to your question is that the RSUs are taxed at vest and upon sale of the resulting shares.

Web Federal tax will be withheld at a flat 25 up to supplemental income of 1M. Web The IRS considers RSUs to be equity-based compensation and taxes them as income in the year you receive them. Web You may be offered 22 or 37.

Above 1M it will be withheld at around 396 or very close to this State tax will be withheld. Capital gains tax only applies if the recipient of RSUs does not sell the stock. Web RSU tax at vesting date is.

Web Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. You want the higher withholdingespecially if youre in a state like California. Because there is no actual stock issued at grant no Section 83b election is.

California taxation of RSU income happens in two steps. Web Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. If held beyond the vesting date the RSU tax when shares are sold is.

Web As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs. Web RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. So if you earned 60000 in salary and received 10000 worth of.

Web RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. RSUs can trigger capital gains tax but only if the stock.

Restricted Stock Units Driven Wealth Management San Diego Certified Financial Planner

Restricted Stock Units Rsus Facts

Comments The Real Cost Of A Faang Relocation From California

Rsu Taxes Explained 4 Tax Strategies For 2022

Stock Options Vs Rsus What S The Difference District Capital

Rsus In A Divorce Divorce Mediator And Divorce Financial Analyst

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Changes In Irs Form 1040 Affect Tax Returns Involving Stock Options Rsus Espps The Mystockoptions Blog

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

How To Handle State Taxation Of Stock Options After You Move

Rsus And Psus A Versatile Tool To Attract And Retain Executive Talent While Providing Unique Defer

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

How Are Rsus Taxed In California Quora

Demystifying Your Amazon Rsus Resilient Asset Management

Comments The Real Cost Of A Faang Relocation From California