puerto rico tax incentives 2021

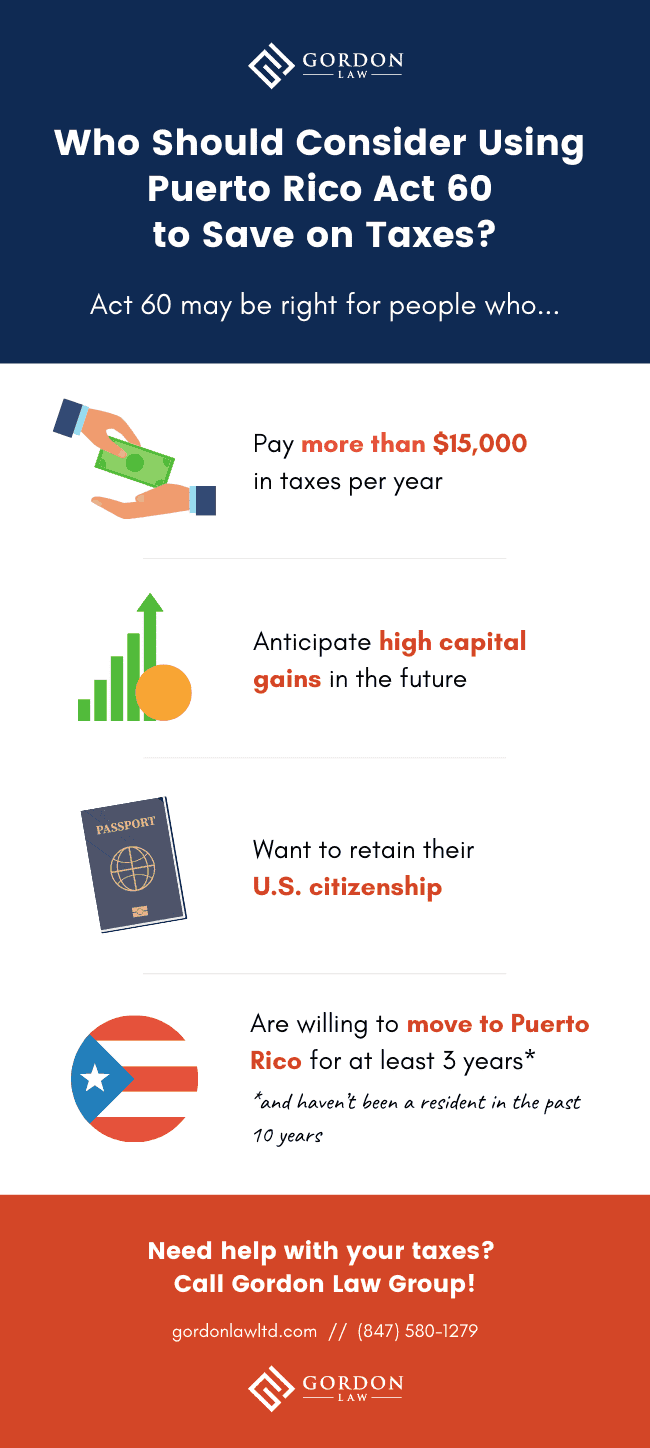

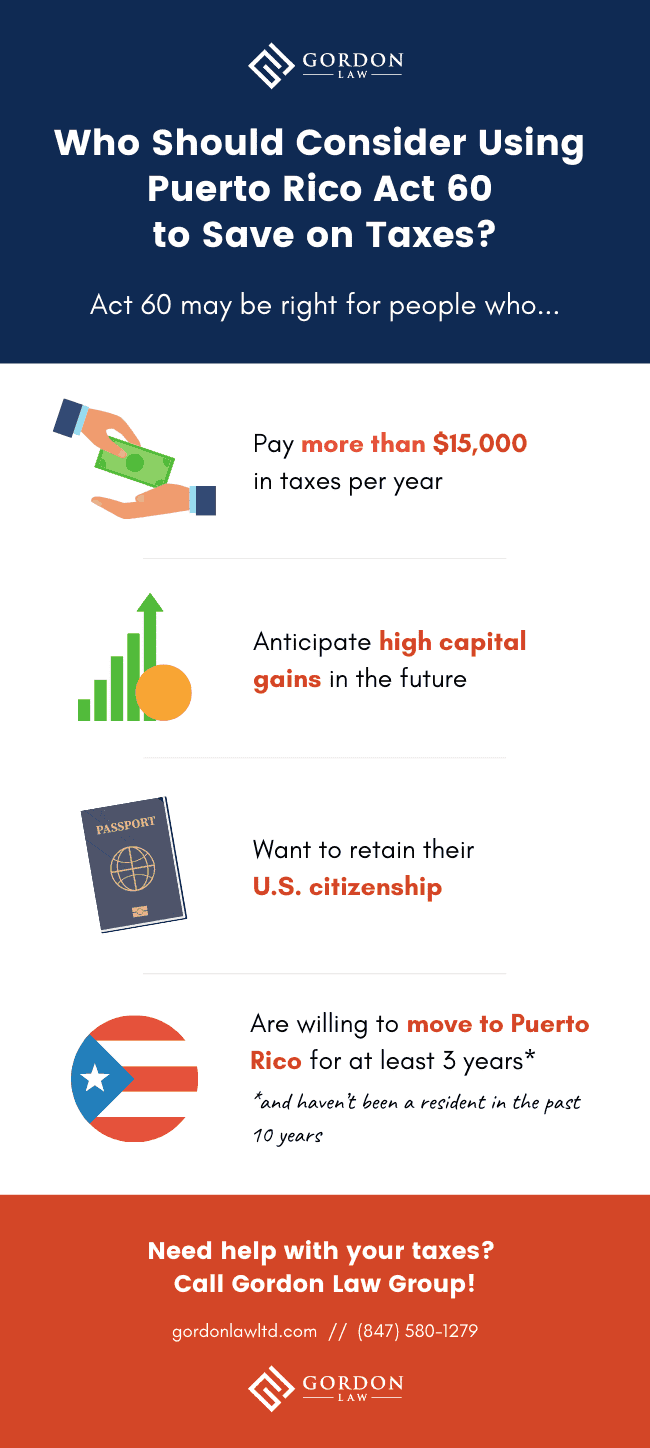

Lets explore the tax implications pitfall and tripwires for US individuals to be aware of before relocating to Puerto Rico. You can earn a significant amount of tax-free income by establishing a permanent residence in Puerto Rico.

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the exportation.

. The political status of Puerto Rico is that of an unincorporated territory of the United. Then in April the Governor signed new legislation which raised the annual filing fee for Act 22 from 300 to 5000. Puerto Rico US Tax.

Puerto Ricos tax incentive Act 14 is titled the Return and Retention of Doctors in Puerto Rico and was established on February 21 2017. Benefits of establishing relocating or expanding businesses in Puerto Rico. And within the first two years of living there you now need to buy a home in Puerto Rico.

4 corporate tax rate for Puerto Rico services companies. Puerto Rico Tax Incentives. Purpose of Puerto Rico Incentives Code Act 60.

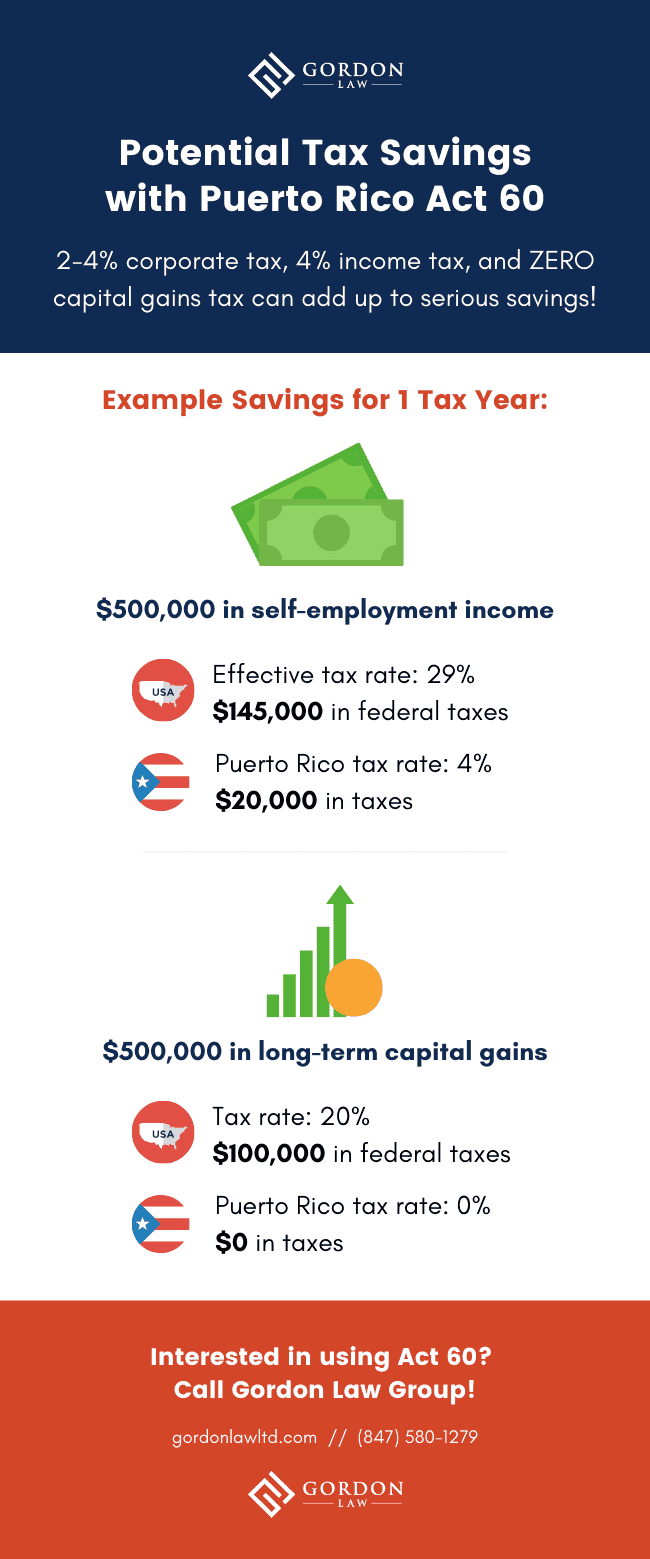

Many high-net worth Taxpayers are understandably upset about the massive US. Puerto Rico Tax Incentives 2021 The Puerto Rico Tax Incentive is a program designed to encourage individuals to invest in Puerto Rico. Puerto Rico offers a 30 tax deduction up to 1500 for expenses incurred in the purchase and installation of solar equipment to heat water for residential use.

Puerto Rico Incentives Code 60 for prior Acts 2020. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world. Those two tax acts offer low to no taxes on certain types of income.

Sometimes effective tax planning can help avoid these taxes. Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Many sizable tax breaks like these are offered across a variety of industries making Puerto Rico Americas last true tax haven. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim the EIC.

Still Puerto Rico hopes to lure American mainlanders with an income tax. As of January 20 2021 the Puerto Rican government has introduced increased fees for tax incentive applications codified in the Incentive Code Regulation. Chapter 2 of the Incentives Act includes measures to attract individual investors to Puerto Rico by providing many incentives to resident individuals such as full tax exemptions on Puerto Rican-source.

Puerto Rico offers tax incentives packages which can prove attractive to US mainland. Act 22 Individual Investors Act. Authored by Manny Muriel.

Citizens that become residents of Puerto Rico. More recently these two acts were updated and combined in a new law called Act 60. In another plebiscite held.

The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000. 28 May 2021. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has.

In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island. Act 20 Export Services Act. October 2021 Learn how and when to remove this template.

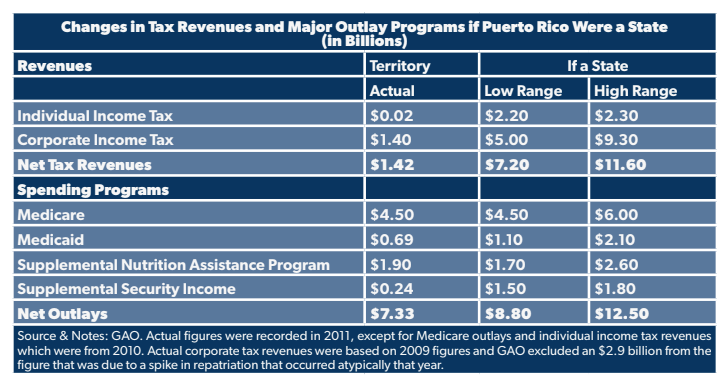

In many if not most cases you must file taxes in two places with the IRS and with the Puerto Rico Department of Finance. Statehood with a gradual phasing out of industrial federal tax incentives. The goal of tax planning is to legally limit minimize and if possible avoid US tax while also.

To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. Detailed description of taxes on individual income in Puerto Rico Gradual adjustment tax. Taxes levied on their employment investment and corporate income.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code. Most recently then Governor of Puerto Rico Ricardo Rossello signed Act 60-2019 Incentives Act into law on July 1 2019 with an effective date of January 1 2020. Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22.

In 1967 and 1993 Commonwealth the name listed for current territorial status won. Posted on June 16 2021 by admin. New Puerto Rico Tax Incentives Code Act 60 Explained 20 22.

100 exemption from income tax on the appreciation in value of the securities or other assets ie cryptocurrency after becoming a bona fide resident of Puerto Rico and realized before January. The credit will range from 5 to 125 of the gross earned income subject to limitations depending on the amount of dependants claimed by the taxpayer. Puerto Ricos Tax Incentive Act 14.

A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US. Despite the increased fees applying for these lucrative tax benefits is still a worthwhile investment however as they can result in a 4 corporate tax rate or a 0 capital gains tax rate. Posted on June 16 2021 by admin.

42 Puerto Rico tax and incentives guide 2021. In Puerto Rico are perhaps the most impressive of all Puerto Rican tax incentives. The Puerto Rican government is luring businesses and investors to their beautiful island with attractive tax incentives like a 4 corporate tax rate and a 0 tax rate on capital gains.

In January of 2012 Puerto Rico passed legislation making it a tax haven for US. The Incentives in a Nutshell. Typically the company engages in providing services to customers outside of Puerto.

27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60. One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. Solar equipment is defined as any equipment capable of using solar energy directly or indirectly to heat water whether such equipment is bought or manufactured by the taxpayer provided that the same is operating.

The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the. As provided by Act 60. 0 capital gain tax for Puerto Rico residents.

If the individuals net taxable income exceeds USD 500000 they will have to pay an additional tax ie.

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Us Tax Filing And Advantages For Americans Living In Puerto Rico

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Filing Your 2021 Tax Return In Puerto Rico

Carveouts From Overseas Profits Tax Sought For Us Territories Roll Call

A Red Card For Puerto Rico Tax Incentives

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

What Logan Paul S Move To Puerto Rico Means Beyond The Tax Breaks

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Guide To Income Tax In Puerto Rico

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Supreme Court Seems Divided Over Puerto Rico S Exclusion From Federal Benefits

Guide To Income Tax In Puerto Rico

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors